Weekly: Budget Planner App

Weekly, LLC

4.8

AD

릴리스 세부정보

| 발행국 | US |

| 국가 출시일 | 2024-06-11 |

| 카테고리 | Finance, Utilities, Productivity |

| 국가 / 지역 | US |

| 개발자 웹사이트 | Weekly, LLC |

| 지원 URL | Weekly, LLC |

| 콘텐츠 등급 | 4+ |

AD

Weekly is a beautiful budget app based on a week. Weekly is the most effective way to plan a budget, stop overspending and save for your money goals.

Weekly is both a budget planner and spending tracker. Weekly starts with a simple guided budget setup where you put in all your recurring bills and income. Next, you add in your savings goals. Then based on those budget items, Weekly calculates for you your weekly spending limit.

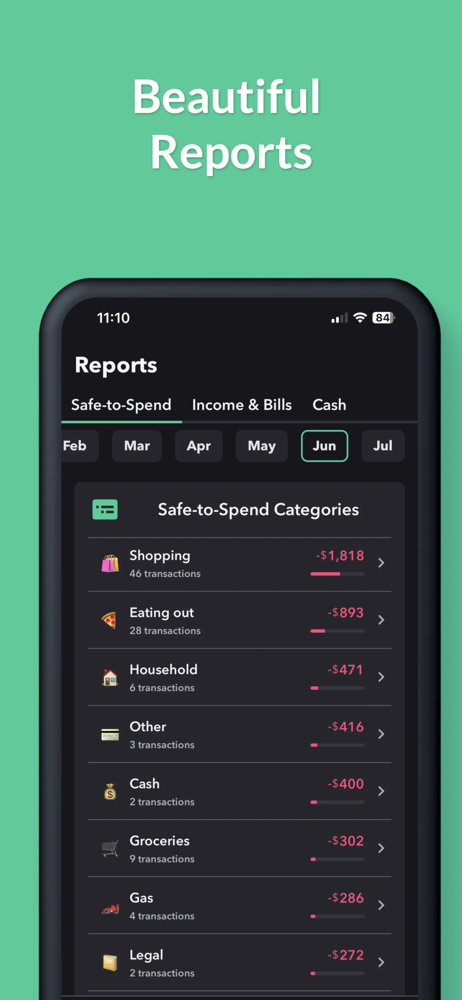

Once your budget is set, our one-of-a-kind spending tracker monitors your day-to-day spending by downloading your transactions from your bank (or you can add them manually). You can then quickly and easily organize your purchases into categories. We will show you how much you are spending on things like “Gas” and “Groceries” or any other category you would like to track. As the weeks go by you can see your average spending by category and challenge yourself to keep your “Safe-to-Spend” balance “in the green”.

Weekly is also a great bill organizer. You will see your upcoming bills and whether they have been paid. Weekly will tell you the number of days left until the next bill is due and notify you when bills are due.

Connect your banks and credit cards to see all your account balances in one place and stay on top of your personal finances and your budget.

Tracking money with Weekly is fun. Use emojis to represent your different recurring bills and safe-to-spend categories. Weekly’s one tap review icons let you quickly confirm your transactions and keep on track with your budget.

Weekly is perfect for household & personal budgets. You can also share Weekly to stay on track with your budget with a spouse or partner.

The steps to budgeting with Weekly.

Step 1: Create Your Budget with the Budget Planner

** Use our guided walkthrough to set up your budget

** Enter your regular income

** Enter your recurring expenses such as your mortgage, car payments, loans, and utilities bills

Step 2: Set Up Funds to Save for Your Goals

** Create funds to save for your goals

** Weekly automatically contributes money to your funds each week

Step 3: Discover Your Weekly Safe-To-Spend

** Weekly calculates what you can safely spend each week

** The calculation takes into account all recurring bills, income and savings goals in your budget

Step 4: Track Your Day-to-Day Spending with our Spending Tracker

** Add in your daily transactions either manually or download them from your bank

** Stay aware of your “Safe-to-Spend” number

** Quickly and easily categorize your day-to-day spending

** See your category spending totals and averages

** Spend worry-free knowing all your bills and savings goals are factored in

Step 5: See Your Bills and Account Balances

** See view upcoming bills and whether they have been paid

** View all your account balances in one place

** See how much cash you are saving

User Testimonials

“Has made budgeting effortless and so easy to follow. For the first time I am able to stay on track. The cost of the subscription is absolutely worth it and has saved me thousands in overspending.”

AllyCat1217, Oct 12, 2024

“Probably the most important app my wife and I have. It throws our ambiguity around finances out the window and sets us up for success each week with an easy to understand, easy to read budgeting app.”

leajere, Jul 10, 2023

Weekly is free to use or you can subscribe to Weekly PRO for our premium features. Weekly PRO subscriptions automatically renew unless auto-renew is turned off at least 24-hours before the end of the current period. Subscriptions may be managed and auto-renewal may be turned off by going to your iPhone Account Settings. Any unused portion of a free trial period will be forfeited if you purchase a subscription to Weekly before your trial expires.

Terms and Conditions - https://weeklybudgeting.com/terms

Privacy Policy - https://www.privacypolicies.com/privacy/view/6c2c1200579f8307c4080c7f9cd94723

평균 평가

2.87K+

평가 내역

추천 리뷰

ashanthonyn 작성

2022-02-19

버전 2.1.0

accessibilityfeature_requestsmonetizationI’ve tried several different budgeting apps and I’ve found that they’re either (1) hands off and require the user to manually track individual expenses or (2) so automated that the whole process tends to be a bit more complicated than it needs to be. Weekly is perfect in that it automatically pulls in transactions (w/ Plaid integration) - keeping the experience relatively hands off - but doesn’t overcomplicate the whole thing. The user experience and interface is super clean and easy to follow. Keeping everything within a ‘week-window’ also makes it more manageable to track expenses and understand how much is ‘left’ to spend based on income. A great app that I would definitely recommend. Just for some feedback points to make the app even better: wish there was a bit of a higher frequency rate at which Plaid pulls in transactions (may not be a Weekly app thing, but more Plaid-related). Also wish there was a way to re-review prior week transactions to reclassify if needed. Lastly, more of a nice to have - would be kind of cool to have a daily-view next to the weekly total. Just to help further ground the user on understanding what their daily budget is to help make better sense of spend limits. Amazing app and will continue to subscribe after weekly trial!

Jinx coke 작성

2021-11-08

버전 1.9.0

accessibilitymonetizationI have tried many budgeting apps from super detailed to basic information. My main challenge has always been I don’t live on a monthly budget. I live weekly even though I do get paid once a month. At the end of the month I was usually low on cash. Also tracking my spending was difficult with all the transactions etc. I even resorted to a weekly cash envelope system. This app is super simple. It covers recurring bills and then the rest is your free to spend cash. So for example gas, most budget apps would put that as a recurring so I would put $209 for the month. But then one week I would spend $65 and then the next week I would spend $40 due to gas price fluctuations. I could never really see if I had surplus or went over until the end of the month. Here the transaction comes up and it takes it from free to spend. If your under it only takes that exact amount from free to spend. So guess what I can see the extra $5 for a latte! Hope all of this makes sense. It’s definitely worth it for me to live with a weekly allowance.

harvardlsd92 작성

2025-06-10

버전 4.2.0

servicefeature_requestsmonetizationNever in my life did I think I’d pay money for a budgeting app - it just seemed counterproductive but as soon as I got started on the app I knew it was something I could stick to. It works with my ADHD brain so well and seriously changed how I look at my money. I went from $0 to $400 in savings in 4 weeks and that might not sound like a lot to some but for me it is! The only things I would change about the app are; I wish there was a way to link my credit card accounts but not have it affect my cash flow. I am paying off my cards but want it separate from my checking and savings while still being able to easily track my numbers; secondly sometimes I want to manually add a transaction for a recurring item, for example if a bill payment is pending on my bank account for days but it’s paid , I want to add in into the app to show that it’s paid on time before it posts and is added into the app..but when I do that it messes up my cash flow for some reason and doesn’t apply the transaction to the recurring item I selected. If I add my paycheck early from the recurring category it makes my cash flow go down by that amount as if I am adding it into my safe to spend. I hope that makes sense . Anyways i love this app and got the yearly subscription which has been totally worth it so far.

스크린샷

AD

AD